With the sky high US inflation rate (8.5% in April 2022!) you must find ways to to safely invest your money in to vehicles that earns you more interest.U.S. Treasury Series I Savings Bonds, or I Bonds, will offer annual interest payments of 9.62% Starting May 1 2022.

If you have money parked in Savings Account, know that, with the current rate of inflation you are losing its value by 8.5% every year! In simple terms, what you can buy with $100 is costing around $108.5 right now.

These hard times are perfect occasion to find both conventional and non-conventional options to beat the inflation. Which is likely to stay high during the course of the year 2022 and 2023.

Table of contents

- What is Series I Bonds Or Treasury Bonds?

- Series I Bonds Interest Rates

- What do Series I bonds pay Monthly?

- How much can i invest in Series I Bond?

- When can i cash out Series I Bonds?

- Do We have to Pay taxes on I bonds Interest?

- Who can buy Series I savings bonds?

- Can a H1B visa holder buy I bonds?

- Where to Buy Series I bonds?

- How to Buy Series I Bonds?

- Is Series I bonds Good Investment?

- Should You Buy Series I Bonds in 2022?

What is Series I Bonds Or Treasury Bonds?

Series I Bonds are savings bonds that are 100% backed by the U.S. federal government. They are specifically designed to protect the value of your money from inflation (The “I” stands for inflation). The interest rate on I Bonds is directly correlated with inflation. If inflation is high, the interest rate is high. If inflation is low, the rate is low.

The Treasury created 30-year I savings Bonds in 1998 so that investors had a tool they could use to fight the inflation. They are also the safest choice of investment as they are backed by the federal government, so unless the government shuts down the interest on the I Bonds is guaranteed.

In short, If you invest $10,000 On I bonds in May 2022 and the interest rates stay close to 9.62% mark, you can get $962 return on investment after 12 months.

Series I Bonds Interest Rates

| From | Through | Interest Rate |

| May 2022 | Oct. 2022 | 9.62% |

| Nov. 2021 | Apr. 2022 | 9.62% |

| May 2021 | Oct. 2021 | 9.62% |

| Nov. 2020 | Apr. 2021 | 9.62% |

| May 2020 | Oct. 2020 | 9.62% |

| Nov. 2019 | Apr. 2020 | 9.83% |

| May 2019 | Oct. 2019 | 10.14% |

| Nov. 2018 | Apr. 2019 | 10.14% |

Above table depicts the historical interest rates for Series I savings bonds for last couple of years. The Interest rate on regular I bond is combination of Fixed Rate (Which is set by the government,currently 0%) and Inflation Rate (which is based on current inflation rate 4.81% for 6 months).

- The fixed interest rate is set at purchase and lasts 30 years. This is currently set at 0%.

- The inflation adjusted-interest rate is calculated twice a year (Usually May 1 and November 1).

What do Series I bonds pay Monthly?

Yes, I Bonds earn interest monthly. However, you only get access to those interest payments when you cash out the bonds or After 30 years of Maturity. The interest you earn is added to the value of the bond twice per year (May and November).

Can I lose money on I bonds?

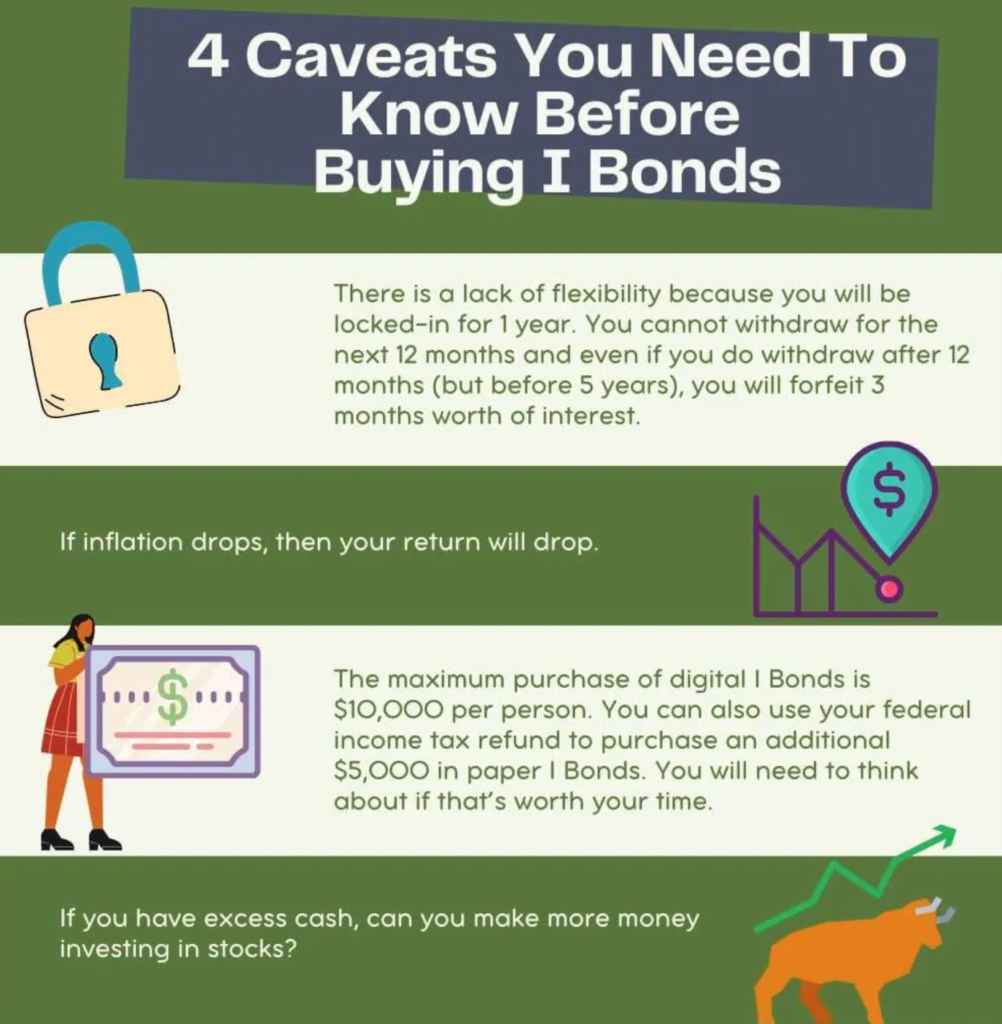

I Bonds can not loose value, Period. The interest rate cannot go below zero hence the redemption value of your I bonds can’t go negative. And seeing the current market inflation is likely going to high during year 2022-23.

How much can i invest in Series I Bond?

In a calendar year, You can buy $10,000 worth of I Bonds per person. Additionally, You can also purchase an additional $5,000 with your tax refund. This is $5,000 per tax return, not per person.

When can i cash out Series I Bonds?

You have to keep your money invested in Series I bond for minimum of 12 months. If you cash out your investment before 5 years you will have to loose last 3 months of interest.I bonds earn interest for 30 years unless you cash them out before then.

Scenario 1: If you want to cash out I bonds before 5 years.

If you want to cash out I bonds before 5 years you loose 3 months of interest. Note, You can not cash out the money before 12 months.

So effective interest you earn on your investment will be 7.21% instead of 9.62%.

Scenario 2: Cashing out I Bonds after 5 years.

In this case, you dont have to pay the penalty of 3 months interest and you will get the full interest on your invested amount.

Do We have to Pay taxes on I bonds Interest?

You do not have to pay State income taxes on i bonds interest earnings. Although, you still have to pay Federal taxes on the interest income on Series I Bonds when you cash them out.

Who can buy Series I savings bonds?

Following people,including emigrants, can buy the I bonds if they suffice below conditions.

| Individuals | Yes, if you have a Social Security Number and meet any one of these three conditions: United States citizen, whether you live in the U.S. or abroad United States resident ( Resident Alien) Civilian employee of the United States, no matter where you live To buy and own an electronic I bond, you must first establish a TreasuryDirect account. |

| Children under 18 | Yes, if they meet one of the conditions above for individuals. Information concerning electronic and paper bonds: Electronic bonds in TreasuryDirect. A parent or other adult custodian may open for the child a TreasuryDirect account that is linked to the adult’s TreasuryDirect account. The parent or other adult custodian can buy securities and conduct other transactions for the child, and other adults can buy savings bonds for the child as gifts. Paper bonds. Adults can buy bonds in the name of a child. |

Can a H1B visa holder buy I bonds?

Any Legal US Immigrant can purchase I-bonds. If you have migrated to US from another country and holds a Valid immigrant Visa like H1B, L2, H4 EAD, F1 Visas. As long as you have a SSN and are a “resident alien for tax purposes” (meaning you file taxes as a U.S. resident and pass either the green card test or the substantial presence test). Since you won’t pass the green card test, you should check whether you pass the substantial presence test.

Where to Buy Series I bonds?

You can not buy I Bonds using your brokerage account like Robinhood or Fidelity. You can only buy it from TresuryDirect– A US Govt site to provide electronic form of Government Bonds. There are Two options to buy the Series I Bonds :

- Buy them in electronic form in our online program TreasuryDirect

- Buy them in paper form using your federal income tax refund

How to Buy Series I Bonds?

- Step 1 : You Must register or sign-in to your free TreasuryDirect.gov account.

- Step 2 : Provide personal information, including:

- Tax ID Number (SSN or EIN)

- E-mail Address

- Bank Account and Routing Number

- Step 3: Choose the following:

- Password

- Password Reminder

- Personalized Image

- Caption

- Security Questions

- Click here to view a Guided Tour of the whole process of opening an account at TresuryDirect.

Is Series I bonds Good Investment?

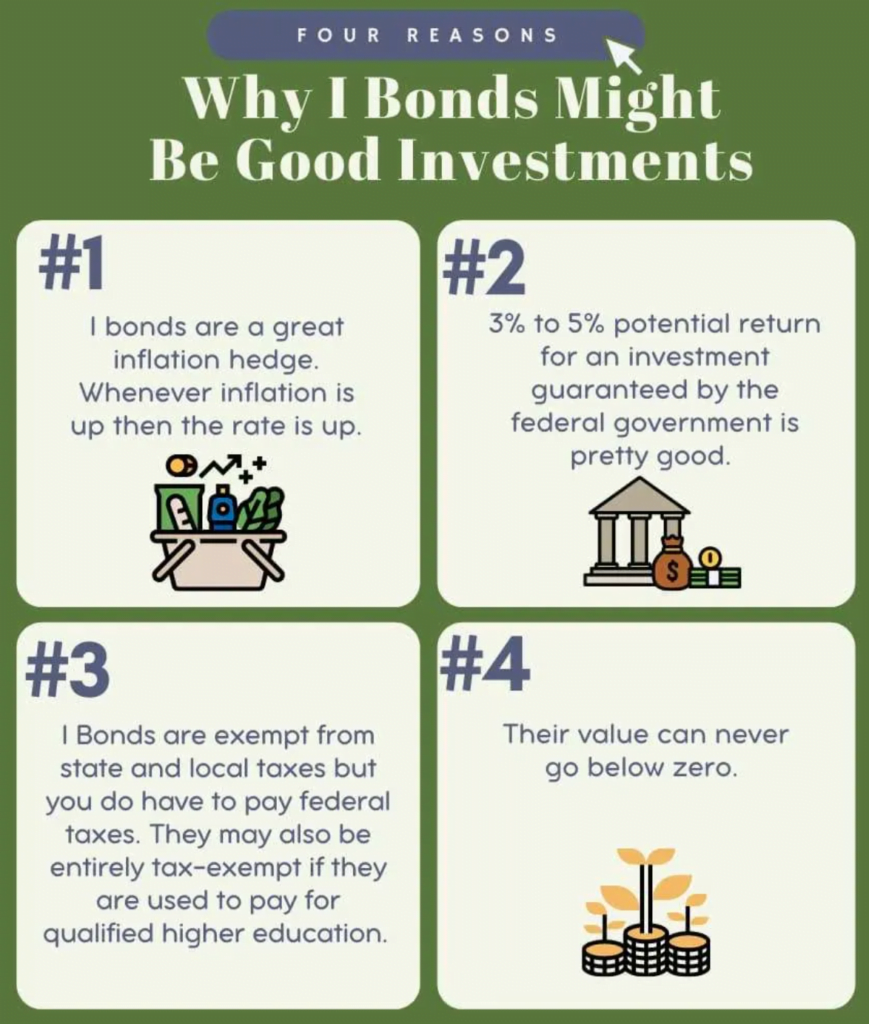

With every investment choice there are pros and cons. Here are some of the pros and cons of buy Series I bonds as investment choice to beat inflation.

Benefits/Pros of Series I bonds as investment in 2022

Disadvantages/cons of Series I bonds investment

Should You Buy Series I Bonds in 2022?

I Bonds interest rate is revised to 9.62% from 7.12% in May 2022. That make I Bonds very attractive choice of investment for investors who want to park their savings. Series I bonds are good investment vehicle for you in following conditions in 2022.

- If you want a Safest investment that will protect your cash from inflation, then you can consider I Bonds instead of investing in Stock Market or Low Yield Savings accounts.

- If you have more than $10,000 savings in your bank account earning close to 0.5% interest and you dont want to invest it in a risky assets like Stocks, ETFs and Cryptos. I bonds are a good choice for you.

- If you are sure you wont need the money you invest in I bonds before 12 months (15 months if you want to get that 9.62% interest)

No Comments

Leave Comment